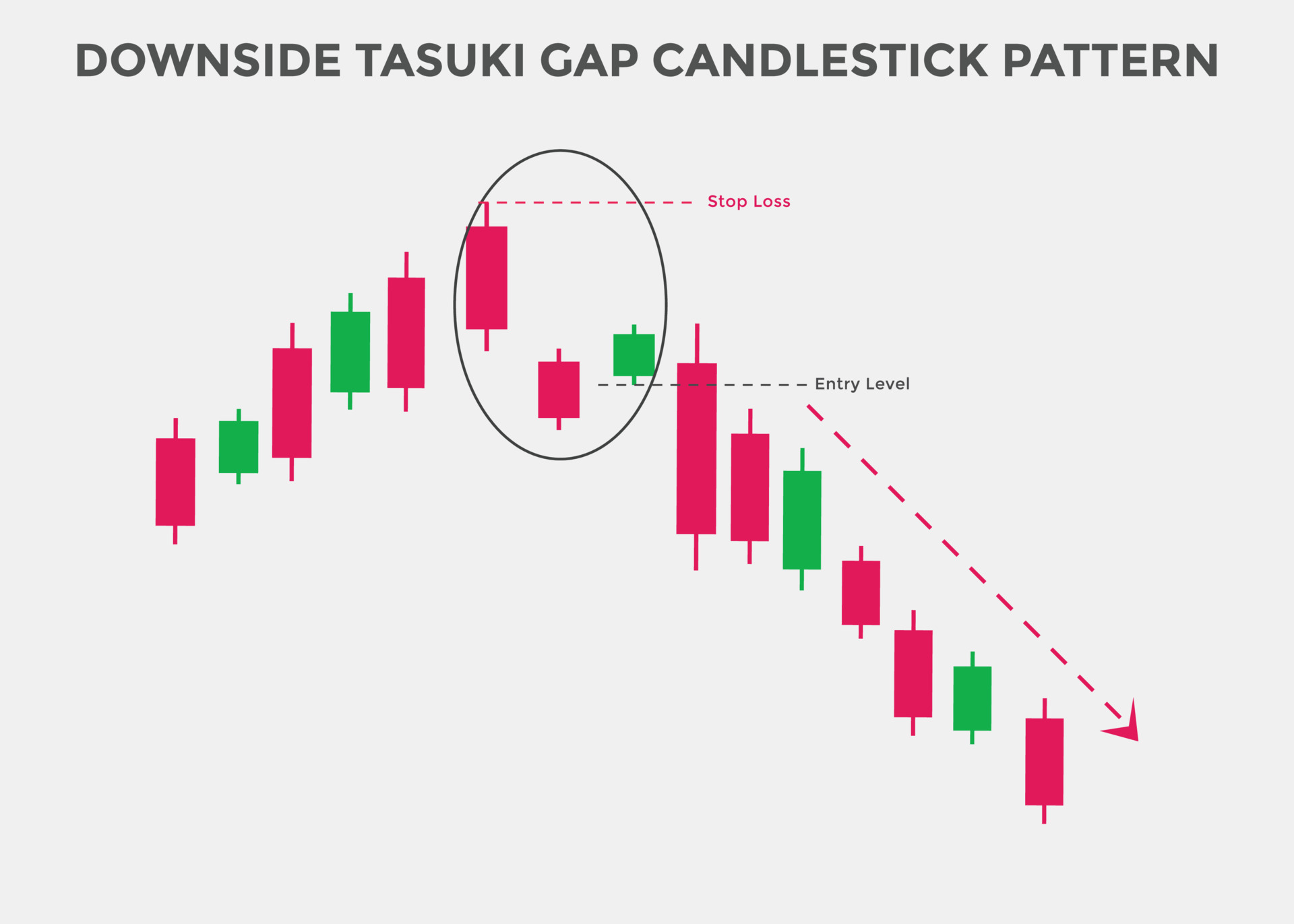

candlestick chart gaps. A ‘gap’ signifies an area on the price chart where no trading activity occurred, due to the opening price of a period being significantly higher or lower than the closing price of the previous one. Here’s how to identify the downside tasuki gap candlestick pattern:

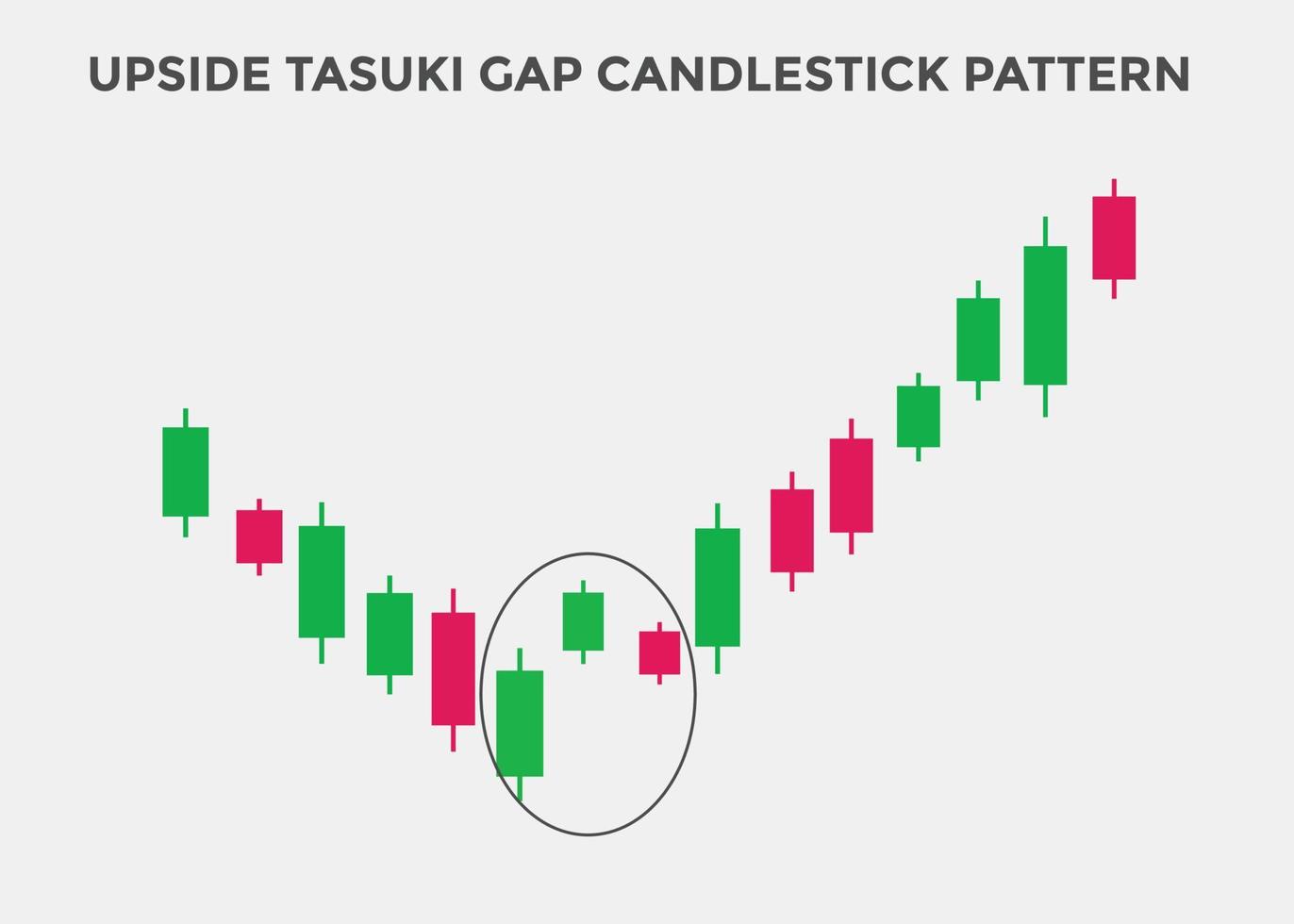

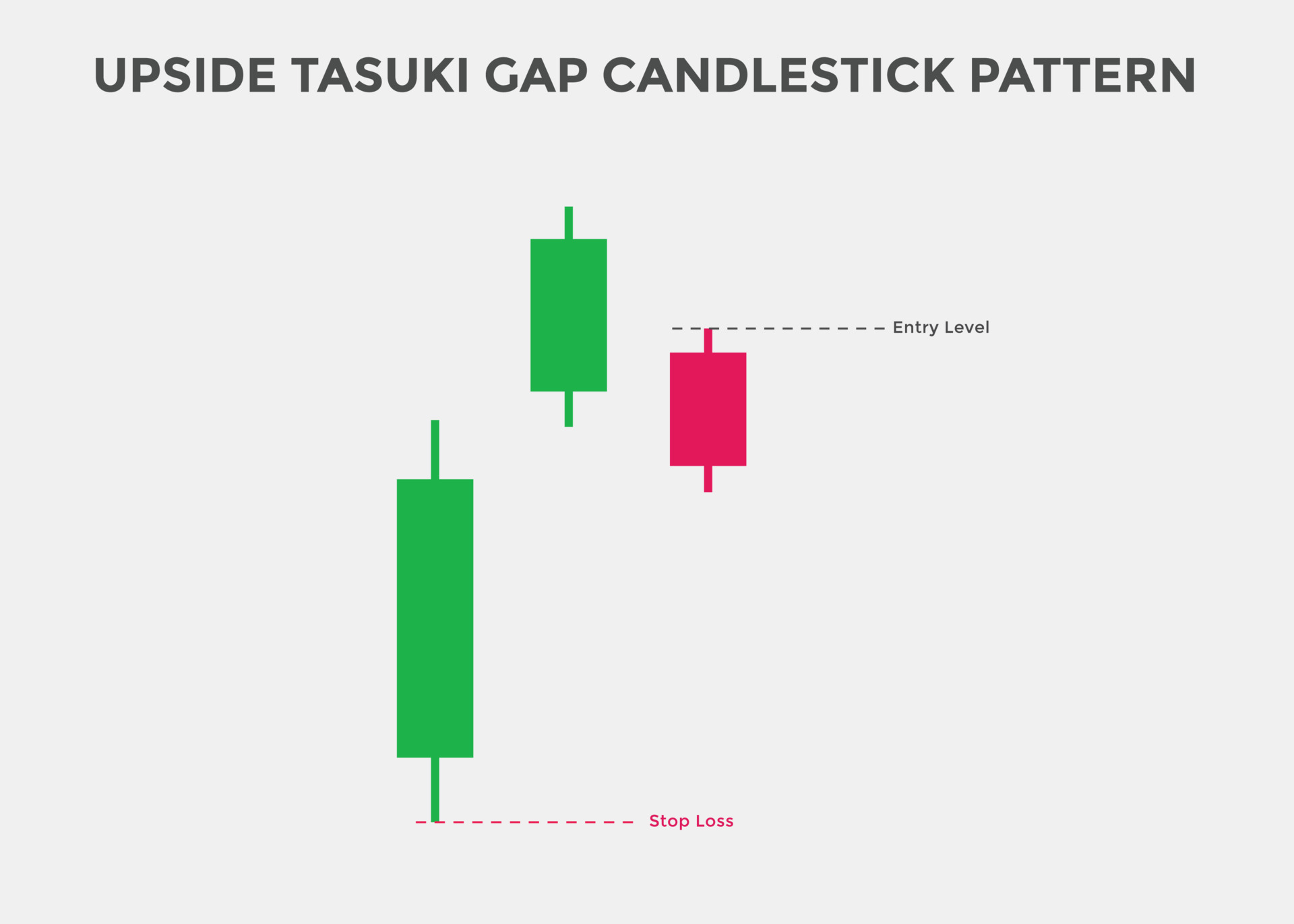

candlestick chart gaps A gap is the difference between the closing price of one candle and the opening price of the next candle. It shows the buyer’s enthusiasm. Gap up in candlestick is an opening of a stock price higher than the previous day’s trading range.

:max_bytes(150000):strip_icc()/UnderstandingBasicCandlestickCharts-01_2-7114a9af472f4a2cb5cbe4878c1767da.png)

It Shows The Buyer’s Enthusiasm.

Price charts often have blank spaces known as gaps, representing times when no shares were traded within a particular price range. A gap in trading is identified by looking at a candlestick chart. A gap is the difference between the closing price of one candle and the opening price of the next candle.

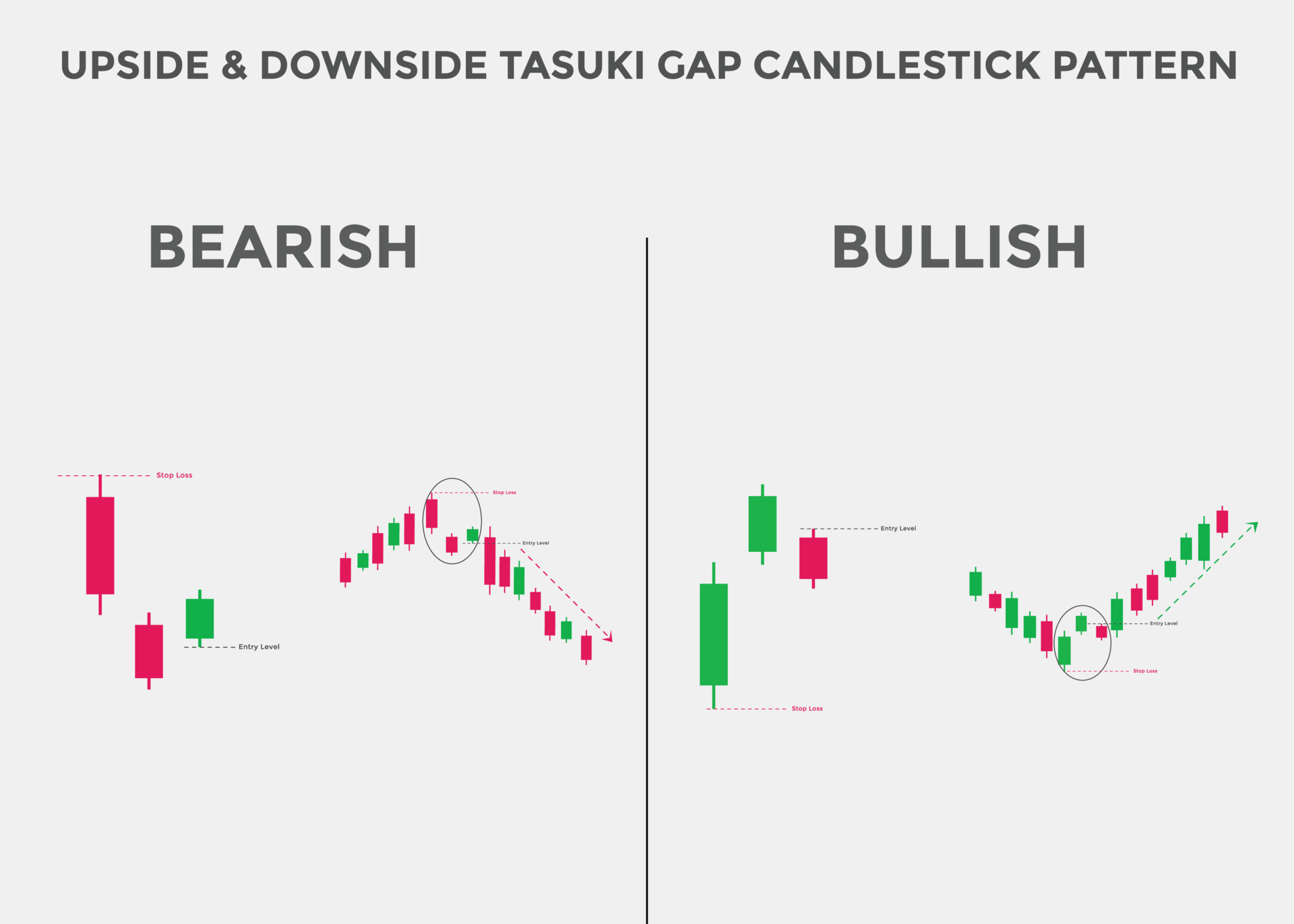

A ‘Gap’ Signifies An Area On The Price Chart Where No Trading Activity Occurred, Due To The Opening Price Of A Period Being Significantly Higher Or Lower Than The Closing Price Of The Previous One.

Two consecutive solid big red candles; Here’s how to identify the downside tasuki gap candlestick pattern: Gaps or candlestick windows occur in stock, futures, or forex charts and can signify areas of resistance or support.

The Gap Candlestick Pattern Is A Distinctive Pattern Often Noted On Price Charts Of Financial Markets.

Gap up in candlestick is an opening of a stock price higher than the previous day’s trading range.